In today’s competitive financial services landscape, offering instantly issued debit cards and credit cards is a necessity. Providing the best instant issuance experience can significantly impact cardholder satisfaction and retention. As the needs of your financial institution evolve, so must the expectations of your instant card issuance solution.

If you’re facing quality, support, pricing, or technology challenges with your current provider, it might be time for a change. Here are five clear signs that it’s time to consider a new instant card issuance solution.

1. Poor card quality

The physical payment card you hand to a customer or member represents your financial institution. Lackluster image quality, flimsy personalization, and long card printing times can reflect poorly on your brand.

Your instant issuance solution should deliver cards that are durable, easy to print, and embody your brand to its fullest. Payment cards that look and feel premium are a key differentiator, especially for regional banks and credit unions looking to stand out in a crowded marketplace.

2. Unreliable service and support

The speed and quality of instant card issuance is only half of the equation. The other is the caliber of service and support. Time is of the essence when issuing a payment card in person. Your financial institution relies on a provider that responds quickly and resolves problems efficiently.

Some providers are part of bigger organizations that may not give instant issuance the attention it deserves. Your financial institution deserves a team of experts you can call on who live and breathe instant issuance. For credit unions and regional banks that take pride in community-based service, a high-touch support model is critical.

3. Price exceeds value

Is the price you pay for instant issuance going up? Does your partner have regular conversations about your pricing model? Do they offer pricing options that create the most value for your financial institution? Pricing is always a consideration when selecting an instant issuance partner, but price doesn’t guarantee value. If the cost of instant issuance is creeping up and service is sliding down, it’s time to reevaluate your provider.

Assess value in terms of features, support, reliability, scalability, and advanced capabilities. Consider whether your provider offers pricing models based on your size and volume of instant card issuance. This could include a flexible monthly subscription plan or one that enables an upfront investment in on-site equipment for added peace of mind. No matter what, a pricing model should adapt to your needs and drive value without compromising quality.

4. Inflexible instant issuance technology

An instant issuance solution is only as good as its integrations to core banking systems and EFT processors. Ask providers for a list of current integrations and discuss how easy it will be to get up and running. An active approach to updating and expanding integrations is imperative to keeping up with the changing needs of your financial institution.

As financial technology evolves, so must your instant issuance solution. Make sure there’s a proactive approach to collecting user feedback and a nimble roadmap that can respond to your requests. A flexible solution that adapts easily will allow your financial institution to stay competitive in a rapidly changing digital environment.

5. Only sees the “instant” in card issuance

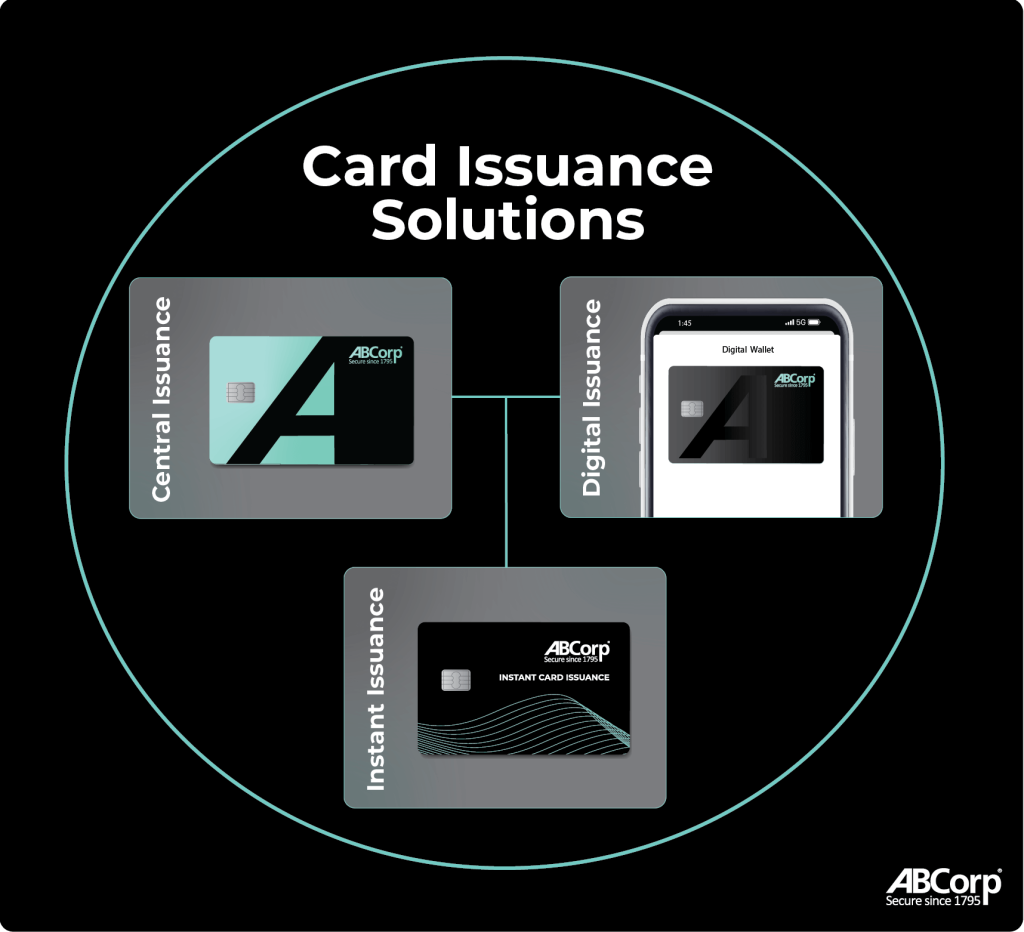

The umbrella of card issuance extends far beyond instant issuance. If your provider focuses exclusively on instant issuance, it may be time to work with one that takes a holistic approach to the entire card ecosystem. Expanding the relationship to include central card issuance and digital card issuance can deliver a better experience for cardholders while saving time and money for your financial institution.

To stay competitive in today’s on-demand world, the right instant issuance provider will meet the needs of today while positioning your financial institution for the future.