In a world shaped by speed and convenience, banks and credit unions must continually evolve to meet rising consumer expectations. Instant issuance, also known as instant issue or instant card issuance, is an effective tool for meeting these expectations. In the world of instant issuing, members and customers leave the branch with a working debit card or credit card in hand.

Instant issuance solutions remove the traditional 7-10 business day waiting periods associated with card replacement or new card issuing. In the age of same-day delivery and mobile-first interactions, that delay is archaic and damaging to account holder satisfaction. Instant card issuing addresses this head-on by fulfilling the modern demand for immediacy, control, and convenience.

Instant issuing is a critical component of the modern, on-demand experience that financial institutions strive to deliver. Financial institutions can provide new and replacement cards immediately at the branch, enhancing satisfaction and engagement. Investing in instant issuance solutions empowers credit unions and banks to deliver a seamless, secure, and competitive service that builds trust and strengthens relationships in a digital-first world.

It’s an offering that’s big and growing. Global technology intelligence firm ABI Research forecasts the worldwide market for instantly issued physical payment cards to increase from 243.2 million shipments in 2022 to 471.1 million in 2027.

What is instant issuance?

Instant card issuance is a technology and service model that allows a bank or credit union to produce a fully functioning debit card or credit card on-site. This service produces fully personalized cards that are ready to use immediately using secure desktop card printers or self-service kiosks.

Instant issuance solutions deliver immediate and frictionless access to an essential financial tool. Instant card issuing provides peace of mind and empowers immediate payment and purchasing power.

The rise of consumer demand for instant gratification

Instance card issuance complements a culture defined by immediacy and real-time experiences including streaming media, booking rideshares, and shopping online. For a financial institution’s cardholders, access to critical banking, financial, and payment tools is no different.

Why instant issuance is a critical touchpoint for credit unions and community banks

Credit unions and community banks are financial institutions often defined by high-touch personal service and community engagement. Instant issuance is an opportunity to deepen relationships and strengthen brand connections with financial institutions by delivering three key advantages:

1. Enhanced Customer and Member Experiences

Instant issuance improves satisfaction by minimizing the downtime associated with lost, stolen, or unavailable payment cards. This immediate fulfillment builds trust and reinforces a financial institution’s role as a reliable financial partner.

2. Increased Card Usage and Activation Rates

Speed-to-spend improves as well. Industry data shows that 47% of instantly issued cards are used within eight hours, and that these cards outperform mailed cards by 53% over a 45-day period in terms of usage.

3. Stronger Security and Reduced Fraud Risk

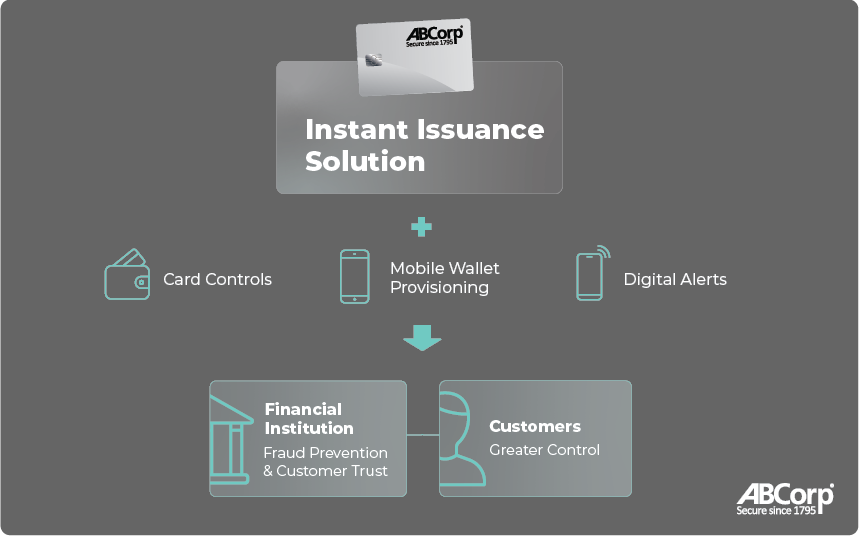

Instant issuance solutions can be paired with mobile wallet provisioning, card controls, and digital alerts, giving customers greater control and financial institutions more robust fraud prevention tools. Reducing the risk of lost or stolen cards in the mail empowers financial institutions to reduce fraud exposure and build trust with account holders.

Instant issuance is no longer a luxury. It has quickly become an industry standard and a customer expectation. For credit unions and community banks, embracing this technology is not just about keeping up with larger competitors. It’s about delivering a level of service that aligns with your financial institution’s mission of responsiveness and trust.