The demand for instant card issuance solutions, meaning the ability of financial institutions to print and personalize payment cards on-demand in branch locations, is increasing. ABI Research predicts the worldwide volume of instantly issued cards to reach more than 470 million in two years.

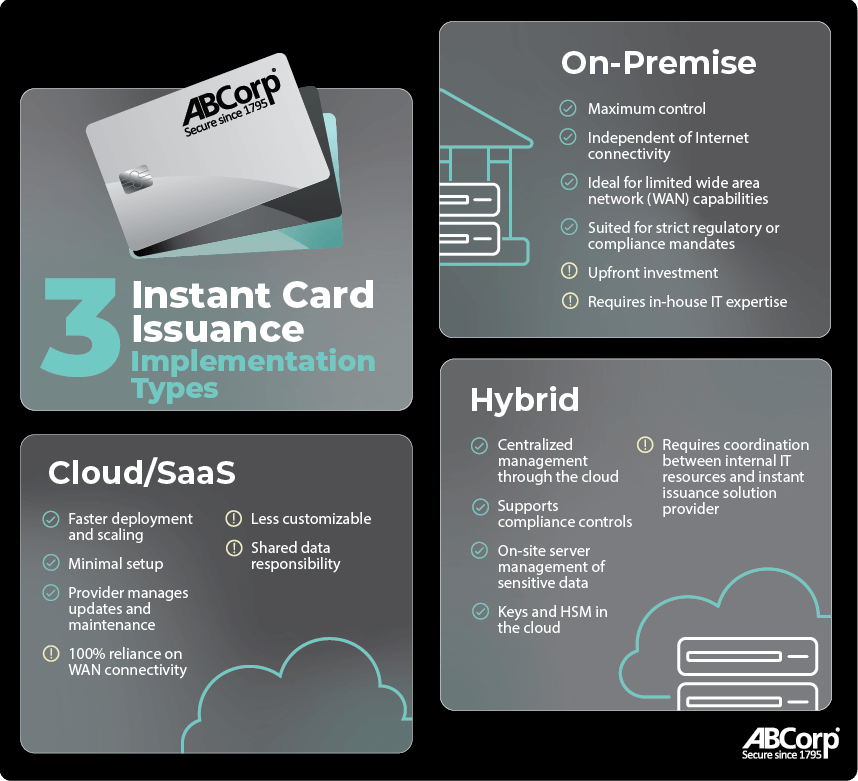

As demand surges, financial institutions face a critical choice when choosing an implementation model that best aligns with their goals. The choice isn’t simple, as there is no one-size fits all. Financial institutions can choose among on-premise, cloud/SaaS, and hybrid models based on infrastructure needs, pricing considerations, security expectations, and growth strategies.

What types of implementations are available for instant card issuance? Understanding three distinct models.

The implementation that a financial institution chooses will be a function of its unique operational needs. Let’s look at the essence of three typical implementation models.

1. On-Premise

Definition: The financial institution hosts the entire instant card issuance ecosystem onsite without any connection to the cloud. This includes servers, hardware security modules (HSMs), personalization software, and printing equipment.

This approach may provide maximum control over data, and the cryptographic keys (e.g., CVV, EMV etc.) and equipment that manages and calculates them. It is independent of internet connectivity and can be ideal for branches with limited or unreliable wide area network (WAN) capabilities. It may also suit financial institutions with strict regulatory or compliance mandates where on-premise oversight is a benefit. Initial capital outlay (hardware expense and software licensing) and ongoing maintenance, updating, and scaling are handled internally by the institution, which may require significant internal information technology (IT) expertise.

2. Cloud/SaaS

Definition: A remote cloud/SaaS provider hosts the entire instant issuance solution, from data to personalization through to reporting. Branches need only card printers and internet access.

This model often offers faster deployment and scaling, allowing institutions to implement instant issuance with minimal setup. Some may benefit from an operational expenditure model that includes predictable, periodic subscription costs. This model typically sources updates and maintenance to the provider, reducing burden on internal IT resources. It also necessitates total reliance on WAN connectivity and can leave branches vulnerable during internet outages. The model may restrict customization, as the financial institution must operate within the constraints of vendor platforms. It also usually requires shared data responsibility, which necessitates trust in vendor security practices and compliance standards.

3. Hybrid

Definition: Hybrid offers a blend of on-premise and cloud/SaaS solution benefits. Key functions including encryption and data backup are cloud-based, while critical branch operations (card personalization and printing) stay local.

For many financial institutions, a hybrid model offers resilience. A hybrid implementation supports compliance control needs, where server management of sensitive data remains on-site and is supported and maintained by a third-party provider. The accompanying cloud infrastructure provides scalability via centralized management and software updates, while also supporting management of the cryptographic keys and HSM. A hybrid model does require close coordination between a financial institution’s internal IT resources and the instant issuance provider, particularly when integrating into the core banking system.

How to choose? Consider flexibility.

On-premise, cloud/SaaS, and hybrid models each address different strategic needs. The best-informed financial institutions will align deployment with risk tolerance, connectivity realities, resource capacity, and growth plans.

Hybrid’s benefits of flexibility, efficiency, and control are often the sweet spot. A hybrid instant issuance solution can be advantageous for financial institutions seeking a balance between innovation and security. Retaining critical elements like encryption and core integration on-premise facilitates compliance with regulatory frameworks while maintaining control over sensitive data. At the same time, cloud-based orchestration and analytics allow operations to scale quickly and adapt to changing market demands. In doing so, financial institutions can enhance the cardholder experience quickly and easily, without significant infrastructure investments.

This dual approach addresses the unique challenges faced by smaller institutions. Community banks and credit unions may operate in environments with limited resources or regular connectivity disruptions. The offline resilience of hybrid solutions can provide uninterrupted service during network outages, which is essential for maintaining trust and operational stability. Leveraging cloud capabilities for functions including monitoring and analytics allows financial institutions to gain actionable insights without overwhelming IT teams.

The hybrid model is ideal for organizations seeking a balance between long-term sustainability and immediate innovation. It empowers financial institutions to meet growing demand for instant issuance and future-proof systems as technological and regulatory landscapes continue to evolve.

Conclusion

Recognizing that one-size does not fit all allows banks and credit unions to choose an instant card issuance solution best suited to their specific needs and circumstances. One that not only meets cardholders’ demand for immediacy, but also supports internal commitments to compliance, performance, and long-term sustainability.