Today’s cardholders expect their cards to reflect who they are. With more than 190 million U.S. adults using credit cards, issuers are facing pressure to deliver faster, smarter, more personalized card experiences. This rising demand is exactly why a modern shift in card personalization solutions is critical.

Modern card personalization blends high-speed manufacturing with secure data handling to ensure every name, account number, expiration date, and CVV/CVC is printed accurately and safely. From the moment a card is manufactured to the moment it’s mailed, the financial bureau plays a crucial role in pairing the right card with the right cardholder.

This blog explores the steps that credit card manufacturing companies use to personalize payment cards within a financial bureau.

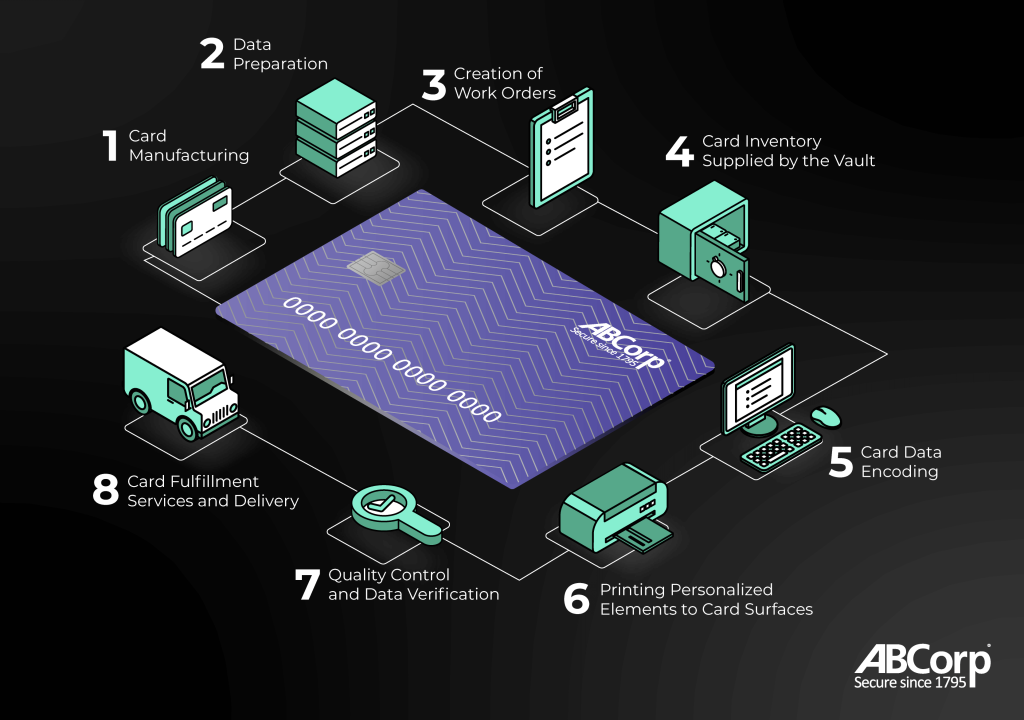

An 8-Step Guide to Debit Card and Credit Card Personalization

Step 1: Card Manufacturing

The first step in this process is to have fully manufactured payment cards ready for personalization. Read our blog post about debit card and credit card manufacturing here.

Step 2: Data Preparation

Before the pre-manufactured cards are personalized, the card issuer (typically a financial institution) aggregates, prepares, and sends cardholder account data to the card manufacturer’s financial bureau. This data may include the account holder’s full name, primary account number (PAN), card expiry date, and security features (CVV/CVC). The file is transmitted securely to the card manufacturer, often using encrypted channels to protect the sensitive information.

Step 3: Creation of Work Orders

Work orders are the backbone of debit card and credit card personalization. Each work order contains detailed information about the activities that need to be completed in each phase of the workflow to produce fully personalized payment cards. Work orders also track the jobs as they run through the system, allowing for real-time updates when needed.

Step 4: Card Inventory Supplied by the Vault

Pre-personalized financial cards are stored in a secure vault with strict access controls. Using the information found on the work order, a corresponding number of cards will be removed from the vault, transferred to the financial bureau, stored securely, and tracked throughout the job.

Step 5: Card Data Encoding

The selected pre-personalized card stock is loaded into the personalization machine and executed in accordance with the corresponding work order data. This is an intricate, coordinated process that includes a variety of steps running through a single machine.

First, the front and back surfaces are cleaned and prepped for printing. Next, the card’s EMV chip and magnetic stripe (if used) are encoded with the cardholder’s account data. The card personalization machine writes this encrypted data to these components, ensuring they can be read by point-of-sale payment terminals and ATM machines.

Step 6: Printing Personalized Elements to Card Surfaces

In this step of the process, personal information is printed directly to the front and back of the card surfaces. There are a variety of printing methods to choose from depending on the card construction, issuer preferences, pricing considerations, and production volume. These methods may include the following:

- Drop on Demand – a precise, high-resolution method that leverages inkjet printing to produce custom images and print cardholder information

- Thermal Transfer – uses heat to transfer ink from the printing ribbon on to the card for long lasting, durable printing

- Laser Engraving – laser engraving provides a sleek look and durability advantages as cardholder information is engraved directly on to cards

- Embossing – a mechanical embosser can press the information directly into the card surface, creating raised characters as found on traditional payment cards

Step 7: Quality Control and Data Verification

The quality of data added during the personalization process must be tracked and verified throughout. ABCorp continuously invests in state-of-the-art equipment and processes to ensure quality control and data verification. Robust quality assurance procedures center on a series of in-process, automated visual inspections and a sophisticated barcode system driven by the card’s personal record. These systems, combined with human oversight, work together to ensure every card meets strict quality standards before it’s shipped.

Step 8: Card Fulfillment Services and Delivery

The work order will also include information about the carriers to be used for mailing, the personal information to be printed on those mailers (cardholder name and address), and the matching of those carriers to the personalized cards. Once matched, the carriers can be folded and paired with other mailed elements, then securely packaged and shipped to cardholders.

Payment Card Personalization is a Key Differentiator for Cardholder Experience

The process of personalizing debit cards and credit cards is a carefully coordinated blend of manufacturing, secure data transfer, and precise delivery. From blank cards to a fully personalized payment form factor, each card goes through an intricate journey that balances speed, accuracy, and security. Ensure your card issuance program is meeting evolving cardholder demands now and into the future.